Leasing vs Buying Solar Panels: Making the Right Choice for Your Home

Embarking on the journey towards solar energy with AZ Solar Consulting is more than just an eco-friendly choice, it's a savvy financial move. But we understand the decision between leasing or buying your solar panels can feel daunting. Leasing offers an affordable entry point into renewable energy, with lower upfront costs and maintenance taken care of. On the other hand, buying requires a heftier initial investment, but potentially leads to greater long-term savings, homeowner tax incentives, and increases your property value. Our goal is to guide you through this important decision, helping you choose the best path in your transition to solar energy. After all, whether you lease or buy, you're making a powerfully green choice.

The Common Ground: Utility Savings, Grid Relief, and Environmental Impact

Choosing to switch to solar power, whether through buying or leasing solar panels, is a significant step towards energy efficiency and environmental stewardship. Each choice offers unique advantages - like cutting down on electricity charges and providing relief to the grid - setting the foundation for a greener home and lower utility bills.

When it comes to leasing vs buying solar panels, several factors come into play. Leasing offers an attractive, low upfront cost solution, transforming your home into a hub of renewable energy with monthly lease payments and maintenance handled by your solar leasing company. It's an easy entry into solar energy without the worry of upfront costs or system upkeep.

On the other hand, buying solar panels is an investment in your home's value and your long-term savings. Yes, the initial cost is higher, but with ownership, you get to benefit from federal solar tax credits and the potential for a lower monthly energy bill. Not to mention, being the owner of the system means that after the pay-off period, the energy savings are all yours. Plus, it's a selling point if you ever decide to move, adding value to your home. Both paths illuminate the way to a more sustainable lifestyle, but the best one for you hinges on your financial and personal considerations.

Solar Leasing vs Buying: Key Differences

When stepping into the world of solar energy, understanding the divergence between leasing and buying solar panels is crucial. These two distinct paths each have their unique nuances, costs, and benefits. Let's unpack these differences to guide you toward an informed decision tailored to your home's needs.

Key Points of Buying vs Leasing Solar Panels

Leasing Solar Panels

Leasing a solar system offers a comfortable entry into the world of renewable energy, with minimal upfront investment. In this scenario, the solar leasing company owns the panels, handling the system's maintenance and repairs. It's akin to having a personal solar energy service without the worries of high upfront costs or technicalities of panel maintenance. However, one key aspect to remember is that as a lessee, you don't own the system, relinquishing ownership benefits such as federal solar tax credits and net metering programs. While you'll enjoy lower monthly energy bills, your lifetime savings may be less than if you owned the panels.

Solar Leasing Key Points:

• Solar system owned by the leasing company.

• Little to no upfront costs.

• Ineligible for tax incentives and net metering programs.

• Maintenance is taken care of by the leasing company.

• Lower monthly energy bills, but potentially less lifetime savings.

Buying Solar Panels

Purchasing solar panels, on the other hand, is a monetary judgment that pays off in the long run. Yes, the initial investment is higher, but ownership comes with its perks. You qualify for tax incentives like the federal solar tax credit and can participate in net metering programs, both of which can significantly offset the overall cost. Moreover, owning the system increases your home's value, a considerable advantage if you plan to sell your home down the line. The financial choice to buy a solar system is not just an environmental decision but also a long-term investment in energy savings.

Solar Buying Key Points:

• You own the solar system.

• Higher initial costs, potentially offset by tax credits and other incentives.

• Eligible for tax credits and net metering programs.

• Greater potential for lifetime savings.

• Responsibility for maintenance lies with the homeowner.

Whether you decide to lease or buy, converting to solar power is a commendable step towards sustainable living. The most suitable option depends on your financial circumstances, long-term plans, and local incentives. So, research thoroughly, consult with a trusted solar panel installer, and make the choice that fits your home and your future.

Solar Leasing vs Buying: A Closer Look at Costs

Peeling back the financial layers of leasing and buying solar panels will equip you with a clearer perspective on which path is right for you. The costs associated with each route can significantly impact your budget and long-term savings, so let's dissect them to see what fits best.

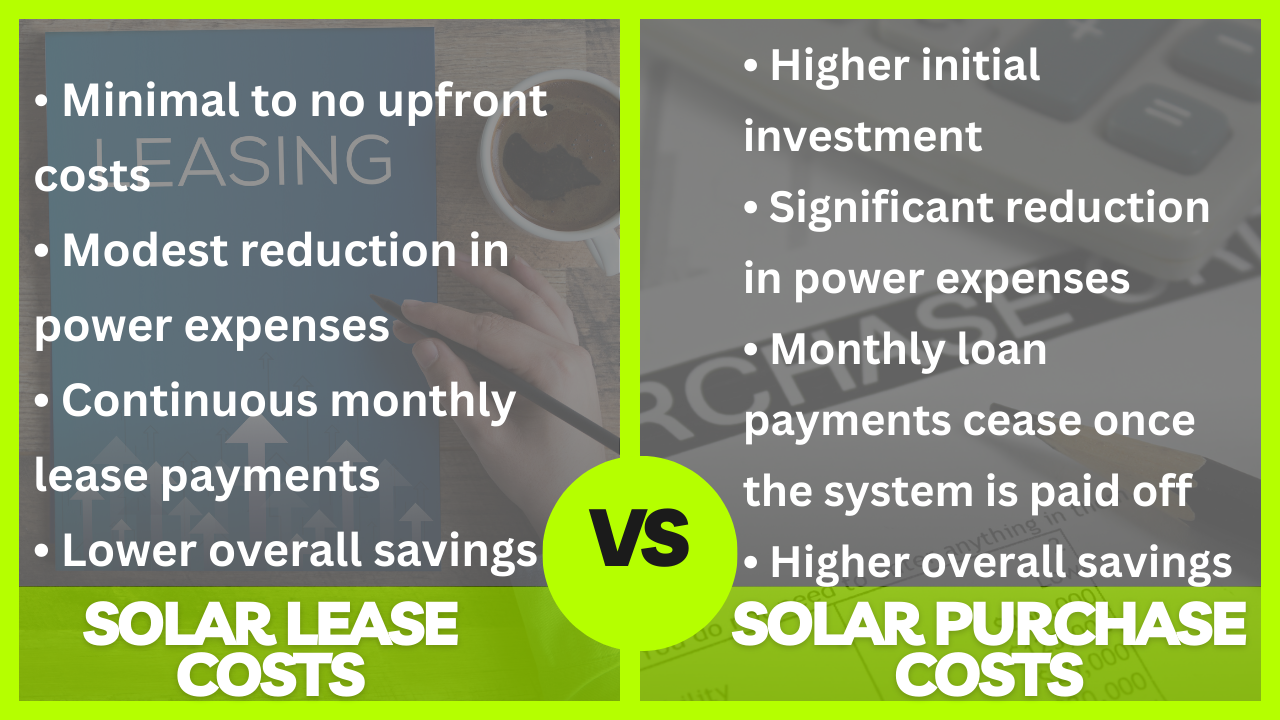

Solar Panel Lease vs Purchase Cost Key Points

Cost of Leasing Solar Panels

Leasing solar panels might sound like a walk in the park with its low upfront costs, but it's worth examining the long-term monetary effects. The exact leasing price can swing depending on your energy usage, location, credit score, and the leasing company's terms. Some solar energy services roll out zero-down agreements, while others might need a down payment.

Leasing may be a beneficial option for those on a tighter budget, as it eliminates the high upfront costs associated with buying. However, the financial pendulum swings over time. Typical monthly lease payments fall between $50 to $250, and over a 25-year lease, you might find yourself shelling out around $45,000. This sum can exceed the costs of outright purchasing the solar panel system, even when you factor in the interest on a solar loan. That being said, over that same time period you would likely have paid the power company double that amount – which is why it still makes sense for so many people.

While leasing solar panels offers the immediate benefit of lower electricity charges, it's essential to remember that your lease payments continue throughout the term. In contrast, if you're the proud owner of the solar panel system, you can relish in the fact that there are no ongoing payments once the system is paid off. This setup allows you to bask in the glow of greater long-term savings.

Solar Lease Cost Key Points:

• Minimal to no upfront costs

• Modest reduction in power expenses

• Continuous monthly lease payments

• Lower overall savings

Cost of Buying Solar Panels

Buying solar panels might seem like a hefty financial decision due to the significant initial investment. However, this economic choice can yield substantial benefits over the long haul. Ownership opens the door to tax credits, net metering programs, and a significant reduction in your energy bills, which can dramatically lower your overall costs and boost your lifetime savings.

The upfront cost of a residential solar panel installation might make you gulp, but the average time to recoup this initial investment through energy savings is between seven to ten years. Plus, as the system's owner, you're eligible for federal tax credits and reimbursements that make this investment even more appealing.

Solar Buying Cost Key Points:

• Higher initial investment

• Significant reduction in power expenses

• Monthly loan payments cease once the system is paid off

• Higher overall savings

Whether you're leaning towards leasing or buying solar panels, the financial implications should be thoroughly considered. Depending on your financial situation and long-term goals, one option might suit you better than the other. Remember, renewable energy is an investment in both your home and the planet. So, take the time to weigh the pros and cons, and you'll be on your way to a brighter, more sustainable future.

Solar Leasing vs Buying: Weighing the Pros and Cons

When it comes to the decision-making process of leasing or buying solar panels, it's crucial to delve deep into the benefits and drawbacks of each route. This way, you can make a well-versed decision that aligns with your personal circumstances and financial goals. Let's break it down.

Leasing Solar Panels: Pros and Cons

When it comes to leasing solar panels, one of the most significant advantages is that the maintenance and repair responsibilities usually fall on the shoulders of the leasing company. That's right, in most cases, you won't have to roll up your sleeves or dip into your pocket if any technical hiccups occur with the panels. That said, you may still need to tackle light maintenance tasks like sweeping off accumulated debris.

Solar Leasing Pros:

Minimal or no initial investment: Leasing solar panels sweeps away the need for a bulky upfront payment, making it a more reachable option for homeowners with tighter budgets.

Low-maintenance living: The solar leasing company typically shoulders the responsibility for the maintenance and repairs of the panels, freeing you from the burden of upkeep.

Drawbacks of Leasing:

No ownership rights: With a solar lease, you're essentially renting the solar panels. This means you won't have control over the energy produced, and you never own your solar system.

Monthly payments can inflate: Many lease agreements come with price escalators, which can cause monthly payments to balloon over time.

Long-term lease commitment: Leases usually span 20 to 25 years, making it tough to bow out of the agreement without incurring hefty penalties.

Reduced electricity savings: Leasing solar panels can lead to lower overall savings compared to buying the panels outright.

No eligibility for tax incentives or net metering programs: Leased solar systems typically don't qualify for tax incentives or net metering programs, which could limit your financial benefits.

Buying Solar Panels: Pros and Cons

The key player in the game of solar panel ownership is return on investment (ROI). Both leasing and buying solar panels offer the potential to shave off considerable dollars from your utility bills, but the ROI can swing wildly depending on your chosen path.

Solar Buying Pros:

Greater long-term savings: Buying solar panels can lead to higher lifetime savings compared to leasing. Despite the higher upfront cost, the return on your initial investment is significant over the 20- to 30-year lifespan of the solar system.

Ownership perks: When you purchase solar panels, you become the proud owner, giving you full control over your energy production.

Access to tax incentives and rebates: Buying panels opens the door to federal and local tax credits, which can slice off a hefty chunk from the overall cost of your solar system.

Boosts your home's value: A residential solar panel installation can significantly increase your home's market value, making it a standout feature for potential buyers.

Stable monthly payments: If you opt for a solar loan, your monthly payments will stay the same, offering financial predictability.

Solar Buying Drawbacks:

Hefty upfront cost: Buying solar panels requires a sizable initial investment, which may be a financial hurdle for some homeowners.

You're in charge of repairs and maintenance: As the owner, you'll need to keep an eye out for any repairs or maintenance tasks that crop up over time.

After weighing the pros and cons, it's clear that buying solar panels is often the more beneficial option for homeowners. While leasing may take the edge off upfront costs, the long-term perks and financial advantages of ownership outshine the initial expenditure. However, for those whose wallets are strained or whose credit scores are less than stellar, leasing can still offer a sustainable way to contribute to the environment and trim down electricity expenses.

So, Which Option Is Best For You?

If you're a homeowner and you're financially secure, you've got two great options for going solar: buying or leasing. Both have their own set of perks, and the best choice really depends on what you're looking for. Both leasing and buying have their own advantages. If you like the idea of trying out solar power without a big upfront investment, leasing could be your best bet. But if you're ready to commit and reap the full benefits of solar power in the long run, buying might be the way to go. Either way, you're making a smart, green choice.

Are You A Good Lease Candidate?

So, you're the type of person who cares about the environment and wants to reduce your ever-increasing electricity bill, but the upfront cost of buying solar panels seems a little steep? Or maybe your credit score isn't exactly through the roof, and securing a solar loan seems out of reach. If that's you, I've got just the solution - leasing solar panels!

Leasing is like the VIP pass to the world of solar energy without burning a hole in your pocket. You can start enjoying lower electricity bills from day one without needing to lay down a large amount of cash upfront. It's like ordering a pizza and getting the first slice free! And the best part? You don't have to worry about maintenance. The leasing company, your new solar energy partner, will take care of all those nitty-gritty details.

Leasing offers flexibility that's hard to beat. You can choose lease terms that fit your lifestyle and future plans. Maybe you're not sure where life will take you in a few years, or perhaps you anticipate some financial changes on the horizon - with leasing, that's no problem at all.

So, if you want an affordable, flexible, and environmentally-friendly way to harness the savings of solar energy without the headaches of maintenance, leasing solar panels could be your perfect match. It's a win for your wallet, a win for your peace of mind, and a big win for our planet.

Should You Own Your Solar Panels?

If you've got the funds for an upfront investment and you're looking at the long game, then buying solar panels might be your best bet.

Here's why: buying solar panels is like putting money in a savings account that pays pretty darn good interest. You put down some cash upfront or apply for 100% financing for $0 upfront cost, but then you start to see savings on your electricity bill straight away. Over time, these savings can outweigh your initial investment. Plus, there are often tax credits and rebates available that make this deal even sweeter.

When you buy solar panels, you're not just a consumer of solar energy, you're the producer. You're in control of your own energy production and you're less dependent on utility companies. This gives you a buffer against fluctuating energy prices and a whole lot of peace of mind.

So, if you're in a position to make the initial investment, buying solar panels is a smart move. You get long-term savings, more control, a potential boost in home value, and the satisfaction of knowing you're doing your bit for the environment. Now that's what I call a win-win!

The Bottom Line

The leasing vs buying debate extends to the realm of solar panels, bringing upfront costs, cumulative savings, and the concept of ownership into the spotlight. The ultimate decision, however, hinges on your unique circumstances and financial capabilities.

The decision between leasing vs buying solar panels is a highly personal one, dictated by your financial situation, personal preferences, and long-term plans. Leasing can provide a more affordable entry point into renewable energy while buying offers more significant long-term savings and benefits.

A solar lease can be an attractive option due to the minimal or even non-existent upfront costs. You're also off the hook for most maintenance tasks, which are typically handled by the solar leasing company. However, a lease often means you're signing up for a long-term commitment - think 20 to 25 years. It's not a decision to be taken lightly.

Additionally, while leasing can lower your monthly energy bills, it may not offer the same level of cumulative savings as buying. Price escalators in the lease agreement can lead to gradually increasing monthly payments. Plus, with a lease, you don't have the advantage of tax incentives or net metering programs, which are financial benefits that can make the cost of solar panels more manageable.

On the flip side, buying solar panels, while requiring a high upfront cost, can lead to greater lifetime savings. Even if you take out a solar loan or a home equity loan for the purchase, you could still save more money in the long run. Moreover, as the owner of the panels, you have full control over your solar system, which can be a significant advantage for some homeowners.

Buying also makes you eligible for federal solar tax credits and other local incentives, reducing the overall cost of the solar panel system. Plus, having a solar system installed on your home can boost its value, a boon if you ever decide to sell.

In either case, the move toward renewable energy and rooftop solar power is a win. Whether you lease or buy, you're contributing to a more sustainable future, reducing your carbon footprint, and likely saving on your energy bills in the process. Take your time, do your research, and consult with a solar panel installer to make the best decision for your home and your wallet.

Now that you know all the details about leasing and owning your solar system, the next step is to go over the numbers to see which option is the best fit for you.

Click the button below or Contact Us to sit down with a trusted solar advisor and get your FREE savings report!

-

Community & News

- Jun 1, 2023 Beating the Heat: Understanding Arizona's Summer Electricity Bills

- May 30, 2023 Batteries Included?: The Ultimate Guide to Choosing the Best Solar Power Bank in 2023

- May 29, 2023 Is Solar A Scam? The Truth About Solar Energy

- May 26, 2023 Top 14 Questions to Ask About Solar Battery Backup Storage Before You Buy

- May 26, 2023 Powering Up: Tesla Power Wall vs Competitors in the Energy Storage Game

- May 23, 2023 Shining the Light on SRP Solar Plans: The Ultimate Guide to Saving Money and the Environment for SRP Customers

- May 22, 2023 Solar Power Costs: The Cost of Doing Nothing

- May 21, 2023 Harnessing the Sun: Your Guide To Solar Companies And Installation In Phoenix

- May 19, 2023 APS Rate Increase in 2023: The Energy Monopoly Strikes Again

-

Solar Power Questions and Answers

- May 31, 2023 Home Value: The Impact of Solar Panels

- May 29, 2023 Is Solar A Scam? The Truth About Solar Energy

- May 26, 2023 Top 14 Questions to Ask About Solar Battery Backup Storage Before You Buy

- May 26, 2023 Powering Up: Tesla Power Wall vs Competitors in the Energy Storage Game

- May 24, 2023 Solar Battery Storage Solutions, And Why You Need Them

- May 23, 2023 Shining the Light on SRP Solar Plans: The Ultimate Guide to Saving Money and the Environment for SRP Customers

- May 22, 2023 Solar Power Costs: The Cost of Doing Nothing

- May 17, 2023 Leasing vs Buying Solar Panels: Making the Right Choice for Your Home

- May 15, 2023 10 Crucial Questions to Ask Before Going Solar

- May 12, 2023 Can You Really Get Free Solar Panels In Arizona?

- Tax Incentives